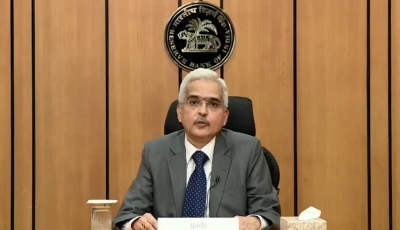

Chennai 5th August : Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday announced the increase of repo or policy rate the rate by 50 basis points (bps) up to 5.4 percent.The repo or policy rate is the rate that the RBI lends short-term money to banks.

The announcement of the decision of the Monetary Policy Committee (MPC) during its three-day meeting Das stated that it was taken a decision to increase the rate of interest by 50 basis points to 5.4 percent with immediate effective.

In line with this, the standing deposit facility (SDF) rate will be 5.15 percent and the marginal SDF will be 5.65 percent.

The MPC also decided to keep its focus on the withdrawal of the facility to ensure that inflation stays within the targets going forward while promoting growth.

According to the RBI due to the high degree of inflation and the resilience in the economy in the country, the MPC considered that further monetary policy actions are required to reduce inflationary pressures.

limit headline inflation to the tolerance band, closer to the goal, and to keep inflation expectations in check so as to ensure growth continues.

These choices are in agreement with the aim of reaching the medium-term goal of achieving a consumer price index (CPI) inflation of 4 percent within a range of approximately 2 percent while promoting expansion, Das said.

He also stated that the economy in the US is showing indications of growing.

Das said that the total foreign direct investment for the first quarter of FY23 was $13.6 billion, an increase of $11.6 billion that was received in the previous year’s comparable period.

The economic activity in the domestic economy as robust, he added that the southwest monsoon rainfall was 6 percent above the average for the long period (LPA).

The Kharif sowing is increasing.

The high frequency indicators of the activity in the service and industrial sectors are holding.

The demand for urban services is growing while demand for rural areas is slowly increasing.

Das said that exports of goods saw a rise of 24.5 percent in the period of April to June 2022 with some moderate growth in July.

Non-oil gold imports were strong and a sign of a rising demand from the domestic market.

The RBI stated that the consumer price index (CPI) inflation fell to 7.0 percent (year-on-year, y-o.-y) between May and June 2022, down from 7.8 percent in April, even though it is still above the upper range of tolerance.

“Food inflation has shown some moderated, particularly with the easing of the prices of edible oils and the deepening of deflation in eggs and pulses.

The inflation of fuel returned to double-digit levels in June, primarily due to the increase in LPG and the price of kerosene.While the core inflation (i.e., CPI excluding fuel and food items) was a bit lower in May and June because of the direct impact of the reduction in excise duty on diesel and petrol prices, which was implemented on May 22nd 2022, the rate remains at an elevated level,” the RBI said.

The reserves of foreign currency in India were recorded at $573.9 billion on the 29th of July.

The RBI Governor said that by taking different aspects into consideration, the gross domestic product (GDP) growth forecast for 2022-23 has been set at 7.2 percent.

The growth in real GDP for Q1:2023-24 has been forecast to be 6.7 percent.

vj/

.